UPDATE: The court granted an extension of the claims filing deadline. The deadline to submit claims is Febuary 4, 2025.

Here’s how to claim your share of our historic $5.5 billion class action settlement: Here’s the link to the official court-approved settlement site.

- Call the official court-authorized claims support toll-free number: 1-800-625-6440;

- Write to: Payment Card Interchange Fee Settlement, P.O. Box 2530, Portland, OR 97208-2530;

- Email: info@PaymentCardSettlement.com;

- Official court-approved website: ;

- Let us know if you have/haven’t received your claim form or have any questions. Connect with us on Twitter (X): @ScanMyPhotosc.

- To file a claim: www.PaymentCardSettlement.com

- Settlement FAQ:

- To discuss an educational webinar for your organization, contact WOCMedia@wrightoncomm.com

- Media Resources:

- Educational settlement materials and spokesperson details: https://pcsoutreachkit.com/mediakit/kit

- Original settlement claims period press release: https://www.prnewswire.com/news-releases/millions-of-us-businesses-eligible-for-a-share-of-5-54b-payment-card-settlement-302003037.html?tc=eml_cleartime

Millions of U.S. Businesses Eligible for a Share of $5.54B Payment Card Settlement [PRNewswire]

Subject: Final Chapter of my 18-Year Legal Battle Culminates in Record-Breaking Settlement in Payment Card Industry [re Payment Card Interchange Fee and Merchant Discount Antitrust Litigation, MDL 1720].

Visa, Mastercard agree to lower credit-card fees in landmark merchant settlement.

”Rich On Tech,” Rich Demuro nationally syndicated radio/podcast show).

Update: The Kim Komando Podcast interview with Mitch Goldstone.

Victory: Historic $5.5 Billion Settlement in Payment Card Industry Lawsuit. Now what?

Remember the 2000 movie Erin Brockovich? This is our ‘Erin Brockovich-like’ moment—18 years in the making. The risks of ScanMyPhotos.com suing the banks, Visa, and MasterCard were unimaginable, but our role as lead plaintiff worked! This press release announcement explains more details on the claims process for millions of businesses. Yet, we have encountered two problems, which are described below.

Buying lottery tickets offers uncertain chances of winning, favoring luck over math skills. In contrast, the $5.5 billion merchant interchange settlement guarantees payment for eligible businesses, providing a reliable avenue for financial compensation without relying on chance.

This is a “David vs. Goliath” story. We are humanizing and personalizing the story, sharing how a small business took on the banks and credit card companies and scored a win for millions of businesses.

FINALLY! We are writing to share a noteworthy development in our 18-year journey that began as a quest to address the exorbitant merchant interchange payment fees imposed by Visa and Mastercard on businesses like mine. This could lead to lower prices as merchants share their recovery with consumers.

As technology evolved, our business shifted from film to digital, significantly reducing costs and enhancing efficiency. This transition wasn’t exclusive to us; Visa and Mastercard also reaped benefits as the outdated method of swiping credit cards with bulky imprinters and mailing carbon copy receipts shifted to lower the risks and costs.

Over the past three decades, my company has directly experienced the weight of excessive credit and debit card fees, recognizing their substantial impact on operational expenses. This realization fueled my determination to advocate for change, sparking a long-standing social media campaign, years of meetings, regularly flying to NYC and D.C., and attending court proceedings to serve as the prominent voice in the litigation—all aimed at raising awareness about this issue that affects every business.

<< Go Digital. Discover the menu of all-new photo scanning services at ScanMyPhotos. >>

In 2005, our advocacy led us to take on the role of a lead plaintiff in the largest antitrust lawsuit in U.S. history, taking on Visa and Mastercard as a pivotal step towards seeking justice for merchants affected by these fees. ScanMyPhotos is pleased to announce that after years of legal proceedings, a settlement has been reached and duly approved by the court.

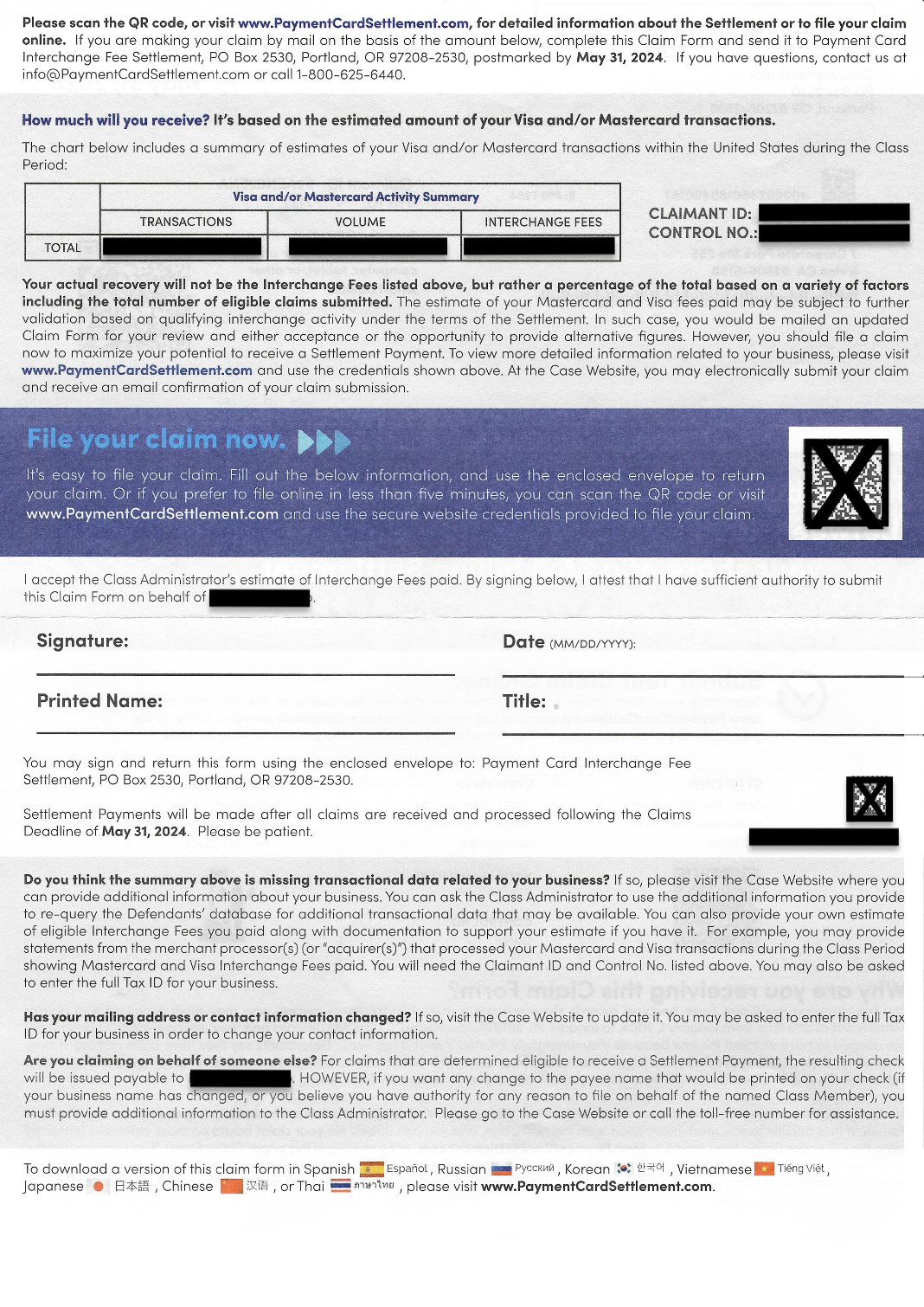

When will I get paid? No payments are expected to be made until after the end of the Claims Period on February 4, 2025. Because the pro rata cannot be determined until all Claims are filed and reviewed and until the Court approves the final amounts, we do not yet know when payments will be made. Please be patient.

The claims period is now open, marking the final chapter of this arduous legal battle. The groundbreaking $5.5 billion settlement is set to be returned to business owners, a momentous occasion where businesses of all sizes are encouraged to claim their rightful share.

Don’t pay anyone to file for you. It’s free. But if you have questions, there is a free way to get all the answers:

Call the toll-free number: 1-800-625-6440

Write to: Payment Card Interchange Fee Settlement, P.O. Box 2530, Portland, OR 97208-2530

Email: info@PaymentCardSettlement.com

Official court-approved website:

This giant settlement substantially relieves larger businesses while providing meaningful benefits to smaller enterprises. In light of recent challenges small businesses face, including the pandemic, supply chain disruptions, labor shortages, and inflation, every bit of support matters immensely.

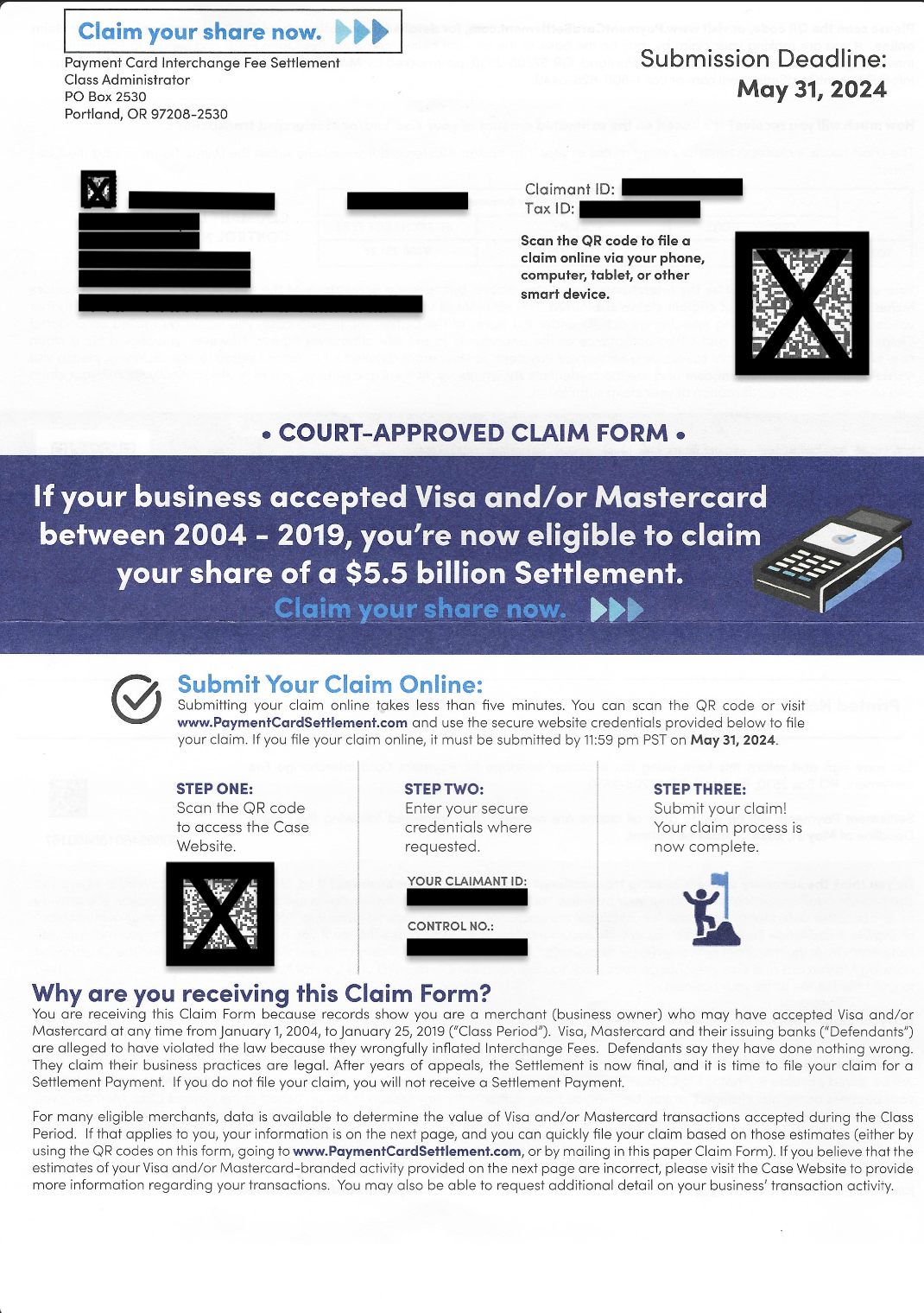

To facilitate a straightforward claim process for business owners, efforts have been made to streamline the submission through a simplified procedure, including a barcode for easy scanning.

While the magnitude of this settlement is unprecedented, it’s important to note that patience will be required due to the involvement of millions of businesses.

For more information about eligibility and assistance in multiple languages, business owners can visit the official website PaymentCardSettlement.com. A claims administrator can also provide no-cost assistance via a toll-free line or email.

The problem now lies in encouraging millions of merchants to return the claim form, which will begin distribution starting today. This marks my next mission—to garner widespread attention and participation in the crucial next step of this process.

Project Title: Maximizing Claims for Small Businesses in the Payment Card Settlement:

At ScanMyPhotos, we’ve taken up a vital mission as the lead plaintiff in the $5.5 billion payment card settlement. Our goal isn’t just to facilitate the claims process and advocate fiercely for small businesses to access their rightful share of this settlement. Through our outreach, media attention, and education, we’re committed to making this settlement a success story for businesses of all sizes. Join us in claiming what’s rightfully yours and contributing to a fair and equitable distribution of this significant settlement fund. Our new advocacy project is more than just facilitating the claims process; it’s about empowering small businesses to step forward confidently, claim their rightful compensation, and collectively ensure that this settlement delivers the deserved restitution to all eligible entities.

Objective: Our advocacy project aims to simplify the claim process and ensure that small businesses, often overlooked in such settlements, can effortlessly access the compensation they deserve. We recognize that the fund distribution operates pro-rata, meaning the fewer claims filed, the greater the share for each claimant. This crucial understanding motivates our drive to encourage more businesses to step forward and claim what is rightfully theirs.

Challenges: Many class action settlements have historically seen low participation from eligible members. Some settlements, particularly those offering relatively insubstantial recovery, have resulted in under-subscription by the class members. Our challenge is to break this trend and ensure that this substantial settlement doesn’t suffer from under-claiming, especially among small businesses. Sadly, companies eligible yet no longer in business will have the claim form mailed to the last known address on file. Many won’t get contacted if that address is no longer active. That is why all must contact Epiq — the official site at PaymentCardSettlement.com and ask for a claim form.

Approach: Through extensive outreach and educational initiatives, we’re committed to informing businesses about the ease and significance of filing a claim. Large corporations might naturally file due to the substantial sums involved, but we focus on empowering smaller entities to participate and maximize their claims.

Outcome: By engaging in robust outreach efforts, we hope to surpass the average participation rate in such settlements, which can be just 5 percent. We hope for 15 percent and more- everyone eligible should get their money. We intend to ensure that businesses—regardless of size—realize the importance of claiming their share, thereby maximizing the overall recovery for all eligible participants.

Two significant challenges require attention:

This is real money: When trade associates were approached, several needed to understand our intent, mistaking it for a solicitation rather than vital news for their members. Overcoming this misunderstanding will ensure all affected parties receive the necessary information.

Don’t be fooled: A concerning trend is emerging. Entities unrelated to the official claims process, like class action settlement firms, are taking advantage of the process. This litigation was all about LOWERING fees, yet some charge a hefty 40% “recovery fee” to do what you can easily do yourself. We even encountered a law firm on TikTok promoting the signing over of claim rights, pledging to manage everything for an undisclosed percentage of the payment—a payment rightfully owed entirely to retailers. We’ve designed the claim form straightforwardly, including a barcode to expedite the process. There’s no necessity to engage anyone else to complete what you can effortlessly do yourself.

ScanMyPhotos.com aims to empower merchants to reclaim what is rightfully theirs without unnecessary intermediaries. This news story also implores all merchants to exercise caution and recognize that they can complete the claim process independently without relinquishing their rights and paying unidentifiable fees. It is super easy for merchants to claim their settlement payment by themselves.

It is time to illuminate these critical issues and educate millions of retailers, including America’s small businesses. Even companies no longer in business may still be eligible for a check.

For more information about eligibility and assistance in multiple languages, business owners can visit the official website PaymentCardSettlement.com. A claims administrator can provide no-cost assistance via a toll-free line or email.

[As lead plaintiff, this is my personal story being shared with you. Let us know if you have/haven’t received your claim form or have any questions. Connect with us on Twitter (X): @ScanMyPhotosc. Mitch Goldstone, CEO, ScanMyPhotos].

###